The Reserve Bank of India’s gold reserves climbed by $446 million to $47.57 billion.

RBI के साथ कमाये

Foreign Currency Reserves: RBI’s gold reserves have also increased. The Reserve Bank of India’s gold reserves climbed by $446 million to $47.57 billion.

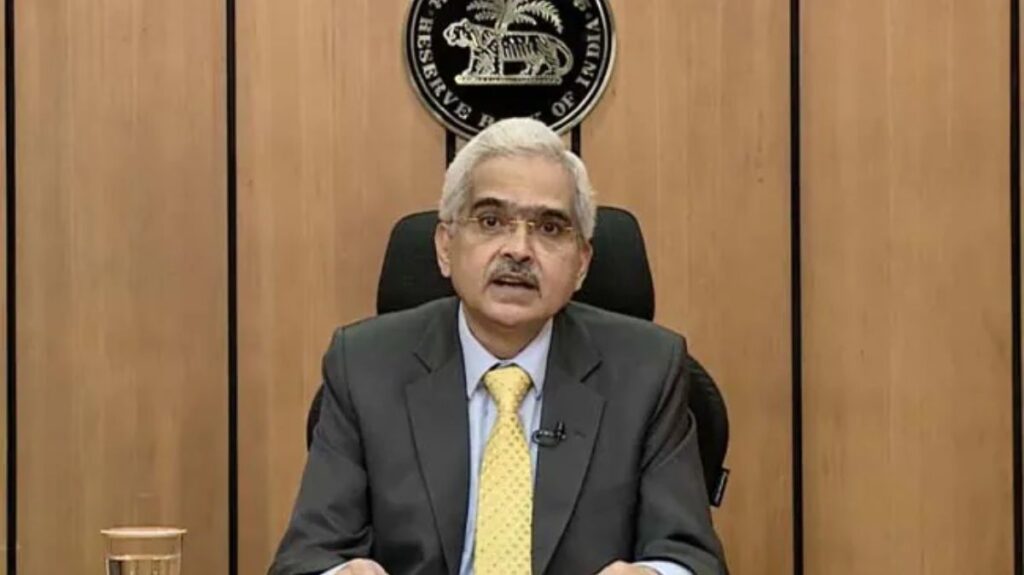

Mumbai: There has been a huge increase in the country’s foreign exchange reserves. India’s foreign exchange reserves rose by $9.11 billion to $615.97 billion in the week ended December 15. Last week this stock was 606.85 billion dollars.

Increase in Foreign Exchange Assets

Reserve Bank has released foreign exchange reserves data on Friday, December 22, 2023. Accordingly, foreign exchange reserves have increased due to increase in foreign investment. Foreign exchange reserves rose by 9.11 billion to $615.97 billion in the week ended December 15. During this period, foreign exchange assets increased by $8.34 billion to $545.04 billion.

Increase in gold reserves

RBI’s gold reserves have also increased. The Reserve Bank of India’s gold reserves climbed by $446 million to $47.57 billion. SDR rose by $135 million to $18.32 billion. Reserves in the International Monetary Fund increased by 181 million dollars to 5.02 billion dollars.

बढ़ोतरी का मुख्य कारण : India’s gold reserves

विदेशी निवेश में वृद्धि विदेशी मुद्रा भंडार में वृद्धि के प्राथमिक कारणों में से एक है। फेडरल रिजर्व द्वारा ब्याज दरें न बढ़ाने का निर्णय लेने और 2024 में संभावित ब्याज दर में कटौती के संकेत देने के बाद, देश में विदेशी निवेश प्रवाह बढ़ गया है। आने वाले साल में विदेशी निवेश शायद और भी ज्यादा बढ़ने वाला है.

विदेशी मुद्रा भंडार तेजी से गिरने से पहले, अक्टूबर 2021 में $645 बिलियन के स्तर पर पहुंच गया, जो पुराने उच्च स्तर के करीब था। विदेशी मुद्रा भंडार अब अपनी पुरानी ऊंचाई से 30 अरब डॉलर दूर है।

Read More : RBI Monetary Policy

MUMBAI: India’s gold reserves

If you want to invest in gold, there is a good opportunity for you. Government is selling cheap gold at below market rate. Last chance to buy this cheap gold is today 22nd December.

Offline and Online Investment :

Investments in the Sovereign Gold Bond Scheme (SBG) Series 3 are now being accepted. This scheme will close on Friday i.e. 22nd December. You have one day left today to invest. You can invest in this gold bond through online and offline channels. Investing in this scheme of the government gives the benefit of both gold price appreciation and interest. Sovereign Gold Bond Scheme 2023-24 has been launched by the government from December 18.

How to invest from a bank account :

आप एसबीआई खाते से स्वर्ण बांड खरीद सकते हैं:

इसके लिए एसबीआई ऑनलाइन बैंकिंग अकाउंट में लॉगइन करना होगा। – अब ई-सर्विसेज टैब पर क्लिक करें और सॉवरेन गोल्ड बॉन्ड पर जाएं। नियम एवं शर्तें चुनें. इसके बाद आगे बढ़ें. निर्देशों के अनुसार अभी आवेदन करें। इसमें आपको एक बार रजिस्ट्रेशन करना होगा. रजिस्ट्रेशन पूरा करने के बाद सबमिट पर क्लिक करें। इसके बाद आप जितना सोना खरीदना चाहते हैं, उसकी मात्रा और नॉमिनी की जानकारी दर्ज करें। अब सबमिट पर क्लिक करें. आप एसबीआई के अलावा पीएनबी, केनरा और आईसीआईसीआई बैंक में नेट बैंकिंग के जरिए खरीदारी कर सकते हैं।

You can invest in sovereign gold bonds through both online and offline methods. Investment in sovereign gold bonds can be made by visiting any bank branch, post office, stock exchange (BSE or NSE) and Stock Holding Corporation of India (SHCIL) and filling the form. Investing in this gold bond gives double profit. You get good return on investment with interest. When you sell these sovereign gold bonds with a tenor of 8 years, you get a return based on the prevailing gold rate.

RBI has fixed the price of gold bonds at Rs 6199 per gram for investment in sovereign gold bond scheme. It has been decided to give a discount of Rs 50 per gram to those who pay online. For these investors, the cost of the bond is Rs 6,149 per gram. Sovereign Gold Bonds earn you an interest rate of 2.50 percent per annum. This interest is paid on half yearly basis. The special thing about this scheme is that you can invest in it for a total of eight years, but you get an option to exit the scheme after five years.

What is Gold Bond?

This scheme is issued by RBI. You can purchase 1 gram to 4 kg of gold. Investing in bonds means you are investing in 24 carat gold. You also get 2.50 percent annual interest on investing here. Any person can buy gold from 1 gram to a maximum of 4 kg under sovereign gold bonds. So the trust can invest in maximum 20 kg of gold.